Filter Resources

A Farewell Message From Tim Koch

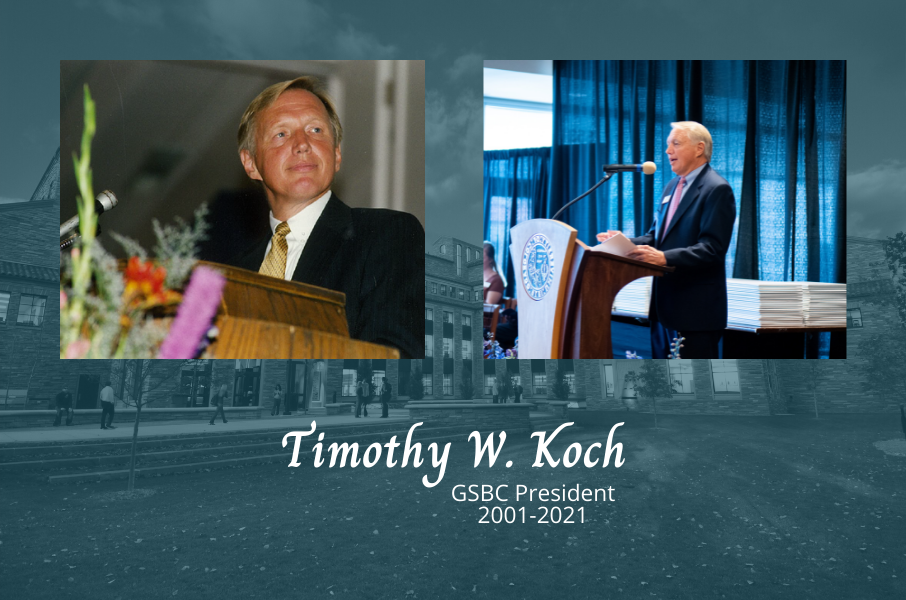

The 70th anniversary session of the Graduate School of Banking at Colorado will end on July 30 coinciding with my retirement after serving as president since October 2000. What a joy it’s been to have the opportunity to meet so many wonderful people who care about community banking.

Annual School Session Curriculum to Address Economic & Regulatory Impacts of COVID-19 & the 2020 Election

GSBC’s electives have been expanded in 2021 to address COVID-19-related challenges and reveal areas of opportunity.

Reflections on the Paycheck Protection Program

The passage of the CARES Act and associated Paycheck Protection Program (PPP) loans have largely consumed bankers since the Small Business Administration (SBA) began accepting applications on April 5.

COVID-19 Updates: Programs Rescheduled, Postponed Due to the Virus

GSBC has cancelled or rescheduled a number of educational programs in 2020 due to the COVID-19 pandemic.

Let’s Celebrate! GSBC Turns 70

For 70 years, the Graduate School of Banking at Colorado (GSBC) has been America’s premier community banking school. Since 1950, GSBC has been entrusted by the financial services industry to develop its leaders with world-class education and unmatched networking opportunities, all at the foot of the Rocky Mountains.

Recession Nearing? Portfolio Strategies for the Year Ahead

What a difference a few months make. In October 2018, the 10-year Treasury rate hit 3.25% and many market participants anticipated two more Federal Reserve rate hikes. The Treasury yield curve was modestly upsloping with longer-term rates above short-term rates. In recent days, the 10-year rate has fallen as low as 2.4% and the yield curve has inverted to where the 10-year rate is slightly below the 3-month Treasury rate.

Curriculum Enhancements Coming to 69th Annual School Session

The competitive landscape for community banks is constantly evolving. Following the 2018 school session, I formed a curriculum review committee to examine the student evaluations of the courses and faculty and to incorporate their diverse expertise to suggest changes. The objective was to ensure that the curriculum reflect the core topics, concepts, and analytical/leadership tools that community bankers need to understand to best lead their organizations and also to address key issues that community banks currently face.

Federal Debt: An Accident Waiting to Happen

The U.S. is facing a federal debt crisis. With current and anticipated federal deficits over the coming years, the amount of outstanding federal debt held by the public is expected to rise sharply. Interest payments on this debt are similarly expected to rise given this higher debt load and the consensus that interest rates will generally rise in the near future.

Is the Bull Market in Bonds Over?

This past December, the Federal Reserve raised the federal funds rate target to between 1.25% and 1.50%. While two of the Fed presidents voted against the decision due largely to concerns that inflation and wage gains were still small and below expectations, Fed Chair Janet Yellen and the others referenced a strengthening labor market and growth in the aggregate economy to support the rate rise. Economic data released since the December decision have, in turn, created considerable uncertainty regarding the path of U.S. interest rates going forward.

How Will Changing Interest Rates Affect the Community Bank Investment Portfolio?

Recent economic data suggest that the U.S. and global economies are growing, yet inflation is modest. Federal Reserve Chairwoman Janet Yellen has, in turn, signaled that the Fed will be cautious in liquidating its $4.5 trillion holdings of long-term securities. Not surprisingly, market participants are unsure as to what the future path of interest rates…

Technology, Regulation and Leadership Topics to be Highlighted in 2017 Curriculum

As economic and competitive conditions change, GSBC constantly revises its curriculum to address current issues. In addition to its core curriculum, in 2017 GSBC will extend coursework to examine the impact of demographic changes, technology changes, management succession issues and macroeconomic/regulatory events as they affect community banks. Demographic Changes The keynote speaker on the opening…