By Timothy Koch, Ph.D., GSBC President and Scott Hein, President, Hein Consulting

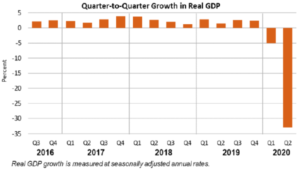

According to the Bureau of Economic Analysis (BEA), real GDP plummeted by 32.9 percent (annualized) in the second quarter of 2020, the largest drop ever recorded. This follows a 5 percent drop in the first quarter. As noted in Figure 1 below, GDP growth was positive in each quarter over the prior four years before the recent pandemic. These recent declines clearly reflect the stay-at-home orders and formal “lockdowns” of local economies intended to stem the spread of COVID-19. Nevertheless, many would have likely sheltered in place on their own to protect their health and those around them. As such, the loss production of goods and services were expected.

The economic implications are especially troubling, as politicians and government officials are making decisions about school openings, extending unemployment benefits, expanding current lockdowns, etc. Consider the following:

- Consumer spending and – ironically – healthcare spending dropped the most

- Personal disposable income increased by 42 percent while the savings rate rose almost 26 percent, suggesting that many have the financial ability to spend more

- Estimated job losses in the U.S. range from 30 million to 40 million through June; most expect their job loss to be temporary, but some of these jobs will disappear permanently

- Continuing unemployment claims increased last week for the first time since early May, and are highest in states (such as New York and California) that instituted lockdowns or were slow to re-open

- Unemployment benefits have been sufficiently large such that they induce some people in certain jobs to remain on unemployment rather than return to work

- Businesses tied to travel (hotels, airlines, rental cars) and dining have suffered extensive losses

- State and local government budgets are in disarray as tax revenues collapse and spending increases

In order to reduce the adverse economic impact, the U.S. Congress has authorized approximately $3 trillion in direct support (transfer payments) of individuals and businesses and the Federal Reserve has implemented many new crisis programs as it has expanded its balance sheet by almost $3 trillion. For fiscal year 2020, the Congressional Budget Office projects the federal budget deficit to be $3.7 trillion such that federal debt held by the public will exceed 100 percent of GDP. The Federal Reserve has also committed to keep interest rates low through 2022.

What would you recommend?

- Extending the supplemental unemployment benefits

- Imposing additional lockdowns and/or extending current ones

- Approving another $1,200 stimulus for select individuals

- Approving federal stimulus for states with budget problems

If we shut down the U.S. economy, will employment rise and GDP growth surge? Are we positioning U.S. lenders for future credit losses?