Bankers track many key interest rates, but surely mortgage rates get a lot of attention, as they can have a significant impact on a community bank’s earnings and profitability. Residential mortgage loans typically represent a meaningful earning asset for many financial institutions. Additionally, an average bank investment portfolio often holds an allocation of mortgage products, the most common of which are mortgage-backed securities (MBSs) and collateralized mortgage obligations (CMOs). Banks purchase these securities to pick up yields vs. Treasury and Agency bonds. Performance of these investments is dependent on the level and path of mortgage and reinvestment rates.

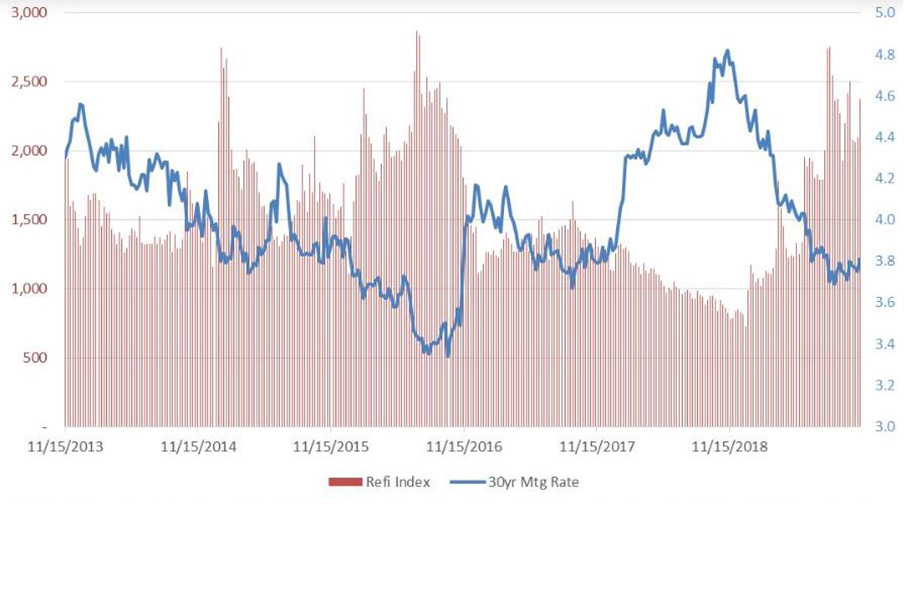

Although mortgage rates do not always move in tandem with the 10-year Treasury bond, the two do exhibit a high degree of correlation. Exhibit 1 reflects recent declines in mortgage rates since the start of 2019 as Treasury yields fell. As these rate indices hit lows mid-year, many investors braced for a spike in refi activity. As evidenced by the MBA Refi Index, August was the month when refi activity peaked. For community banks actively selling mortgage loans on the secondary market, this creates opportunities for increased revenues as loan originations rise. For portfolio lenders and those with a higher allocation in MBS and CMO securities, heightened refi activity could translate to increased cash flow and adverse return implications.

By Todd Taylor, CPA, CFA, Founder & President, Taylor Advisors